philadelphia wage tax for non residents

Nonresident employees who mistakenly had wage tax withheld during the time they were required to perform their duties from home. Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city.

2020 Pennsylvania Payroll Tax Rates Abacus Payroll

The tax has often been cited as a job killer but it raises so much money that the city cant easily replace it.

. Catfish Restaurants In Grove Ok. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. The Philadelphia Department of Revenue has not changed its Wage Tax policy during the COVID-19 pandemic.

City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. Philadelphia nonresident employees are not subject to the citys wage tax for at-home work. Withholding of payments that are less than 5000 during the calendar year are optional and at the discretion of the payor.

Wage Tax policy guidance for non-resident employees. Sales Tax Reno Nv 2021. The rate for residents remains unchanged at 38712.

The new wage tax rate for non-residents who are subject to the Philadelphia City Wage Tax is 35019. People who live in the city no matter where they work must always pay the 38712 resident wage tax. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712.

City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. April 14 2020 716 AM. On the other hand if Philadelphia.

Non-residents who work in Philadelphia must also pay the City Wage Tax. The refund is allowable only for periods during which a non-resident employee was. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes.

The City of Philadelphia announced yesterday that there will be a wage tax rate increase for non-residents starting July 1 2020. February 13 2022. The Wage Tax rate for residents of Philadelphia will remain the same at 38712.

All Philadelphia residents owe the City Wage Tax regardless of where they work. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019. An employer may choose to continue.

Paychecks issued by employers that operate in the city must apply the new tax rate to all wage payments issued to nonresident employees with a pay date after June 30 2020 the city said in a news. A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Pennsylvania law requires withholding at a rate of 307 percent on non-wage Pennsylvania source income payments made to nonresidents.

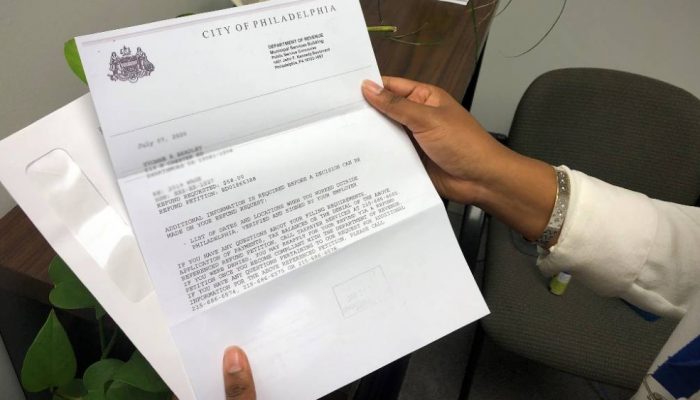

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. News release City of Philadelphia June 30 2020. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

2020 Philadelphia City Wage Tax Refunds for Non-City Residents Required to Work from Home Due to COVID-19. Under this standard a nonresident employee is not subject to the Wage Tax when the employer requires him or her to perform a job outside of Philadelphia ie. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia.

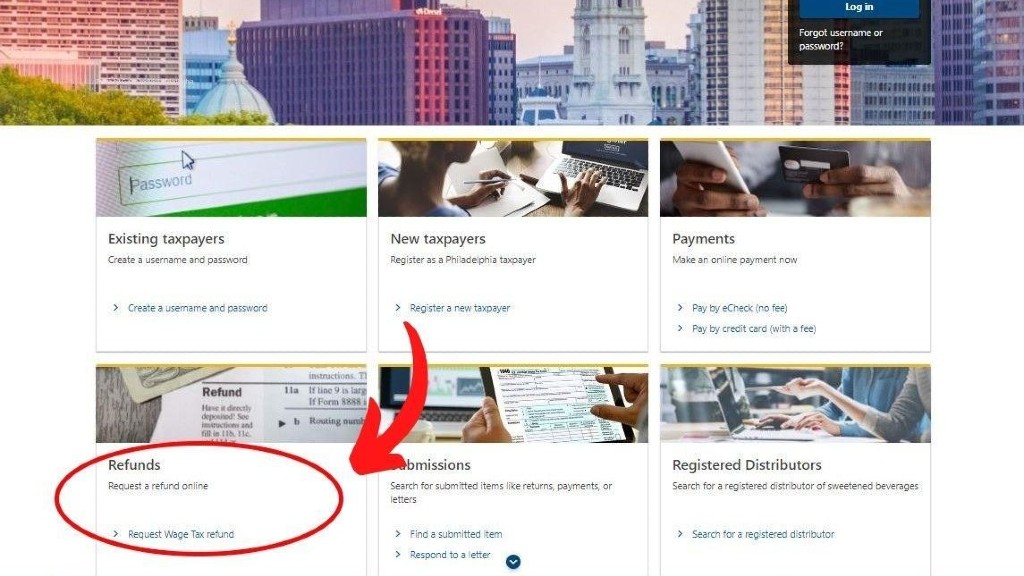

For help getting started and answers to common questions you can see our online tax center guide. The Philadelphia Wage Tax for non-resident employees will increase beginning Wednesday July 1 2020. Tax rate for nonresidents who work in Philadelphia.

The wage tax rate for residents of Philadelphia was not increased and remains at 38712 038712. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax reconciliation.

The city of Philadelphia increased its wage tax rate for nonresidents to 35019 from 34481 effective July 1 2020 the citys revenue department said on its website. Any paycheck issued with a pay date after June 30 2020 must withhold the Philadelphia City Wage Tax at this new rate for non-resident employees. Starting in 2022 you must complete quarterly returns and payments for this tax electronically on the Philadelphia Tax Center.

The City of Philadelphia announced that effective July 1 2020 the Wage Tax rate for nonresidents is 35019 an increase from the previous rate of 34481. Mandarin Chinese Restaurant Lahore. As long as companies are requiring employees to work from home they are exempt from the 34481 nonresident tax.

Residents are subject to the tax regardless of where they work. City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

For residents of Philadelphia or 34481 for non-residents. The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. 35019 035019 an increase from 34481 034481.

The new Wage Tax rate for non-residents of Philadelphia who are subject to the Philadelphia City Wage Tax is 34567 034567. Nonresident employees who work in Philadelphia are not subject to the citys wage tax during the time they are required to work outside of the city because of the new coronavirus the citys. Philadelphia Wage Tax For Non Residents.

Before COVID-19 companies withheld Philadelphia wage tax from paychecks automatically. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

The Chilly Banana Home In 2022 One Banana Chilli Coconut Milk Whipped Cream

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

What Kind Of Corporation You Are Some Businesses Have To Pay Out A Flat Rate For Franchise Tax One B Tax Deductions Medical Device Sales Wage Garnishment

Tax Preparation Service In Maryland Pennsylvania Tax Debt Irs Taxes Tax Debt Relief

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

How To Stop Student Loan Wage Garnishment

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed Org Word Free Templates Word Template

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

![]()

Philadelphia Wage Tax Refunds What S New For 2020 Plenty

Job Board Pnp Staffing Group Job Board Staffing Agency Non Profit Jobs

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Who Pays Wage Tax And When Department Of Revenue City Of Philadelphia

Philadelphia Launches New City Tax Site Brinker Simpson

Youtube Prince Music Hands Up Dont Shoot Duvernay

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia